Bali seems more popular and crowded than ever. New resorts, hotels, villas and condos are popping up on the island constantly, while the new airport and more direct flights ship in huge volumes of tourists from all over the world, eager to enjoy a vacation or short getaway on the Island of the Gods.

Although the tourist industry is booming, some are wondering if the development in Bali is going too fast for its own good – it has already taken a turn for the worse, especially in terms of traffic jams and garbage. So how long will Bali be able to stay on top of the game to keep its visitors happy and content, and what do these changes mean when it comes to the property market?

According to Bill Barnett, managing director and founder of C9 Hotelworks Company Limited, a hospitality consulting firm specializing in tourism, hotel and property development in the Asia Pacific region, the development in Bali is not unlike other resort markets in the Asian region. “Areas like Phuket or Bali are growing into urban resort destinations,” he said. “Life is no longer just about the beach; instead, these are becoming seaside cities. There are lots of places that have seen this evolution, like Waikiki or Miami Beach, so it’s a natural progression in development.”

Despite these similarities, Barnett still sees unique property traits for resort islands in Asia. “Penang is mostly high-rise condo and higher density, while Phuket is higher into the development cycle,” he explains. “Bali, on the other hand, is different and unique, but has such a strong brand that it has unharnessed potential.”

After having conducted extensive research on the area, Barnett last year predicted a greater shift from luxury buyers to those more keen on entry-level products – something which has been proven right. “The real sales pace is at entry level projects aimed at Indonesian buyers; about 80% of the market is domestic so this is the driver of broad demand,” Barnett says.

However, he added that new luxury projects have brought in wider demand. Among them are The Stairs, a villa hotel located in Seminyak and envisioned by star designer Philippe Starck; luxury resort Rosewood Tanah Lot Bali; and Bali’s long-standing Amanusa, which first opened its doors over 20 years ago but recently launched new high-end luxury villas.

“This will help increase top end traction, so most of the real estate action is at the top and low parts of the market,” Barnett says. The balance still goes in favour of the locals.”

“Things are still heavily weighted on domestic market,” Barnett explains. “Unless there is a reform concerning the land ownership and debt available to foreigners, the domestic market will continue to be the broader part of demand.”

But with the southern part of Bali almost being over-crowded, developers are already looking at new hotspots to build more properties and cater to tourists with different needs – in terms of foreign tourist arrivals, Australians still lead the way ahead of China – but these developers are not necessarily eyeing other parts of Bali, but rather searching for business options beyond the island’s shores.

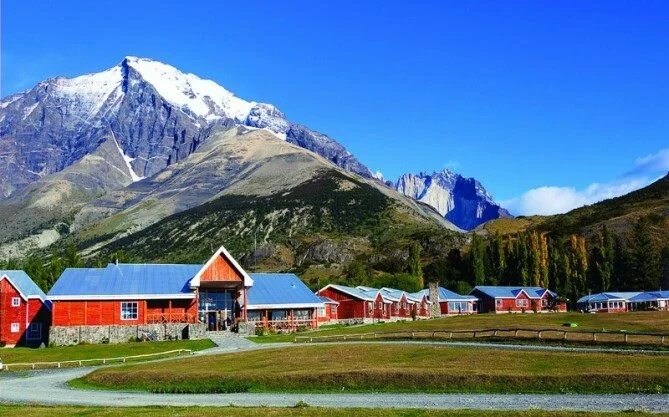

“We are seeing the outer islands of Bali take off,” Barnett says, citing Gili Meno and the southwest part of Lombok as an example of emerging markets. “One project that is on our radar is the new hotel branded villas in Sengiggi, developed by the Latitude Group and managed by Archipelago under the Royal Kamuela brand. This has ignited new interest in Lombok.”

Lombok may be not be a new kid on the block in terms of tourism, but while it has always had a reputation for attracting a lot of backpackers – which is especially true for the three Gili islands in the northeast – the island has recently cranked it up a notch or two with more high-end and posh developments.

South Bali’s outer islands, such as Nusa Lembongan, Nusa Ceningan or Nusa Penida, have also risen in popularity. While a few years ago, these islands were still mainly untouched, these days a rising number of villas and small boutique hotels lure more and more tourists away from Bali.

They are also highly lucrative for developers. While the land price in Bali’s popular areas like Seminyak and Batu Belig has gone over US$ 2,000 per square metre, it still remains relatively low on Bali’s outer islands at between US$ 200 and 300.

According to Barnett, there is a great possibility that developers will shift even further to the east in the future, pointing at untapped potential on islands like Flores. The Komodo National Park sparks great interest among travellers, and the number of tourists has already gone up thanks to an improved infrastructure – a fact that is also showing in the island’s real estate prices which have doubled over the span of only a few years. “One thing for certain is things will never be the same,” Barnett pragmatically concludes. “It’s the cycle of development.”

Katrin Figge